Guidance on benefit eligibility as businesses start to reopen in California

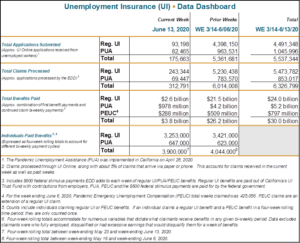

Sacramento – Applications for unemployment benefits ticked down slightly as total benefits paid since the start of the COVID-19 pandemic soar past $30 billion, according to the latest weekly statistics released by the California Employment Development Department (EDD) today. The EDD processed another 312,791 claims last week alone between regular Unemployment Insurance (UI) and Pandemic Unemployment Assistance (PUA) programs totaling now more than 6.3 million claims since the sudden surge of the pandemic began in the week ending March 14, 2020.

Guidance for workers and employers as businesses start to reopen

As businesses start to reopen in California under the state government guidelines, the EDD has developed a series of FAQs on our COVID-19 webpages to assist workers and employers in understanding impacts on the eligibility for UI benefits. If individuals collecting UI benefits are offered the chance to return to their jobs and refuse that opportunity, they will need to report this information on their bi-weekly certification form in answer to question #4, “Did you refuse any work?“ A refusal to work legally requires an EDD representative to review the case and follow up for more information from the claimant as well as the employer before determining whether the claimant can continue to receive unemployment benefits.

- Good cause provisions for UI eligibility – The EDD will need to make a case-by-case determination on whether or not the information provided by claimants about refusing work meets what are called “good cause” reasons for UI eligibility. Such reasons include the higher risk factorsidentified by the California Department of Public Health such as the worker being over the age of 65, immunocompromised, or having certain serious health conditions.

- Reduced work hours and UI eligibility – Workers may still be eligible for partial UI benefits if they are only able to work reduced hours due to the impacts of the pandemic. But they must report that income earned in response to question #6 on their bi-weekly certification form for ongoing benefit payments. The first $25 or 25 percent of wages, whichever is the greater amount, is not counted as wages earned and will not be deducted from the UI weekly benefit amount.

-

- For example, if you earned $100 in a week, the Department would not count $25 as wages and would only deduct $75 from your weekly benefit amount. For someone who has a weekly benefit amount of $450, they would be paid a reduced amount of $375.

- If someone with the same weekly benefit amount of $450 but earned at least $600 in the week, the full $450 would be deducted leaving $0 left for any unemployment benefits that week.

- An individual has a year-long benefit period on their claim to collect the up to 26 weeks of benefits available. Claimants can start collecting benefits, stop for a while when they return to work, and then re-open their claim later if they once again find themselves unemployed or working reduced hours.

- School employees and UI eligibility – Federal and state law do not permit school employees to be eligible for regular UI benefits during a school recess period, including the summer break. That’s as long as these employees base their claim on their school wages and they are scheduled or likely to return to their usual or similar job when the break is over. Despite schools closing early this year due to the pandemic, the US Department of Labor is requiring all states to treat this year as any other. Therefore, the EDD must determine on a case-by-case basis whether employees have reasonable assurance that they will be returning to work in the fall and if so, deny eligibility for benefits this summer.

-

- An exception to this is if workers have enough wages during their base period that were earned from non-school employment to support an alternate weekly benefit amount they can be paid on their UI claim.

- Video tutorials to help workers in certifying for benefits – Many workers may not realize that once it is determined that they have enough in earnings over the last 12- 18 months to initiate a UI claim or a PUA claim, they must answer basic questions every two weeks on their continued claim certification form online or via mail in order to receive the next bi-weekly benefit payment. The EDD provides video tutorials in four different languages to assist workers with this legally required step to determine ongoing eligibility for benefits.

# # # # #

I received my confirmation letter via mail I would receive my benefits, plus the $600 until July 25.2020. I then received a debit card loaded from 03/25/20 – 05/08/20 .in the the letter it said I needed to file a claim every 2weeks I am on the PUA UI…

You cannot registry with an Edd Customer Account Number. I was never email or sent one. I have called without anyone to answer everyday at least 3-4 to a days all 7 numbers I have. And emails which asks you if you need your Edd Customer Account Number. They respond “ you Need your Edd Customer Account Number “ yes I know that is why I am emailing 8x … no help . The only help we are getting is from others who are in the same situation. Millions are just waiting for a Edd Customer Account Number… that’s all. We hope you can help

Garry Cooperman

It ticked down because numerous people are being denied! CA is out of MONEY ! vote these democrats OUT !