EDD provides updates on new text messages, hiring, and pending claims

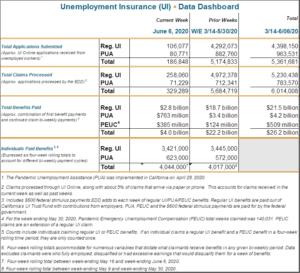

Sacramento – Demand for unemployment benefits in California continues to grow with another 329,289 claims processed last week between regular Unemployment Insurance (UI) and the separate Pandemic Unemployment Assistance (PUA) program. According to the latest data from the Employment Development Department (EDD), the overall total of claims processed since the COVID-19 impact began in mid-March is now over 6 million and $26.2 billion in benefits have been paid to workers in need.

Update on new text message service for claimants

To better serve our customers, the EDD launched a new text notification option for individuals to receive updates about their unemployment claims including new messages about monitoring your postal mail for a notice about submitting identity documents to the EDD, your identity has been verified and it’s time to certify for benefits, or we have automatically filed a Pandemic Emergency Unemployment Compensation 13-week extension on your claim.

Since implementing a few weeks ago, the EDD has sent more than two million text messages and we want to make sure people know that that these messages will not ask them to submit anything – they just provide updates on claim status. For now, the text alerts are sent from 877-324-1224 to the phone number included on an application for benefits. Visit Text Alerts for Unemployment Claims for more information.

The EDD expands mass hiring effort

With increased federal funding due to increased claim activity, the EDD continues to expedite a mass hiring effort to fill more than 4,800 positions over the next several weeks. So far, several hundred are already on board and in training while more than 1,700 have received conditional job offers. The new hires are needed to help EDD quickly increase capacity and serve an unprecedented number of Californians in need of unemployment benefits. For those interested in a number of different positions from entry level technicians and customer service representatives to auditors and accountants, visit the EDD Careers page.

Common reasons unemployment claims can be in “pending” status

A “pending” status means a potential eligibility issue is identified on either an initial application for benefits or an individual’s certification for a bi-weekly benefit payment once the individual already has a claim established. Certifying is the legally required process of answering some basic questions every two weeks that informs the EDD that you remain unemployed or with reduced hours and meet all eligibility requirements in order to receive a bi-weekly benefit payment. Eligibility issues require EDD staff to follow up to review the claim to determine next steps.

Common reasons an initial application will require more time to process

- We need to verify the claimant’s identity.

In order to protect individuals’ personally identifiable information and protect the integrity of UI benefits, the EDD verifies the identity information provided when claimants apply for benefits through the DMV and the Social Security Administration. If it doesn’t match up, claimants will be required to go through an identity verification process.

They will receive a Notice of Award with $0 available until we can verify their identity, and a Request for Identity Verification notice requiring individuals to provide the EDD two types of identity documents as proof you are the true owner of the Social Security Number (SSN) reported. The EDD has found many individuals have inaccurately entered their SSN and so reminds individuals to ensure all information is accurate before submitting an application for benefits.

- The earnings information provided doesn’t match EDD records.

The EDD matches up the earnings information provided applications with wage records reported to us by employers. If there is a mixture of W2 reported wages from an employer and 1099 information provided by a self-employed claimant, the claim will have to be reviewed by staff to determine if there is enough in wages to support a regular UI claim. Claimants who do not have sufficient employment wages to support a regular UI claim may be eligible for Pandemic Unemployment Assistance (PUA), a federal CARES Act program designed to assist business owners, self-employed, independent contractors and others not eligible for regular UI who are unemployed due to COVID-19.

- An error was made on the application or it was incomplete.

The UI and PUA programs are partial wage replacement programs and the EDD must base any benefits awarded on the information supplied in an application. If claimants don’t provide all of their employment history information over the last 18 months, or make a mistake on the date when they became impacted by the pandemic, the claim must be forwarded for staff review.

Common reasons a certification for a bi-weekly benefit payment will be pending or not paid

- A claimant is not able and available to work.

An individual must remain able and available to work when called upon in order to maintain eligibility for unemployment benefits. If individuals indicate in any one of the six questions on the continued claim certification that they were not able or available, they could be found ineligible for benefits that week. But just because someone may be found ineligible for benefits one week doesn’t mean they can’t be found eligible the following week depending on how they answer the questions. Once a claim is initiated, individuals have 12 months to use the benefits associated with it and there are often times someone will be eligible for benefits one week, not the next, but return to eligibility later. The EDD advises claimants review information about the certifying process so you can understand the questions and answer them appropriately.

- A claimant earned too much in income during the week.

Per legal requirements, individuals must report any earnings on their bi-weekly continued claim form in the week in which they worked, regardless of when they get paid.

The first $25 or 25% of their wages, whichever is the greater amount, will not be deducted from their potential benefit amount but the rest will. For example, if someone earned $100 in a week, EDD would not count $25 of it as wages and would only deduct $75 from the unemployment benefit amount. For a benefit amount that is the maximum of $450, the individual would then receive a reduced amount of $375. With more businesses starting to re-open, here are details workers should know:

- If individuals are on a regular UI claim and return to work, they must report their gross earnings in the week in which they worked (regardless of when they were paid) on their bi-weekly certification form to avoid any penalties that could occur if they fail to report earnings and EDD discovers it through other reporting means. This applies whether individuals are working for an employer or are self-employed and are collecting regular UI benefits. If they return to work full time and no longer need the unemployment benefits, they can simply stop certifying for benefit payments. Their claim would become inactive unless they need to reopen it later and collect benefits again within their benefit year.

- It’s a little different in regards to self-employment income on a PUA claim. Business owners, independent contractors and the self-employed would report their gross income earnings on their continued claims certifications in the weeks they actually receive these earnings, regardless of whether or not any self-employment services were performed during the week. If services in self-employment are performed during a week, but no income is received, then they do not need to report any income on their certification.

- A claimant may have refused an offer of suitable work.

To be eligible for unemployment benefits individuals must be out of work or working reduced hours through no fault of their own. Individuals are asked on the bi-weekly certification if they have refused any work. If the answer is yes, staff will have to review the certification and the individual will be scheduled to a telephone eligibility interview. The EDD will ask for the reason the offer of suitable work was refused.

The EDD will also contact the employer that offered the job. If staff determine that the refusal to return to a job or other suitable work do not meet good cause provisions, the individual could be determined ineligible to receive benefits. Employers do have the opportunity to protest the eligibility of the individual.

- The EDD provides more information in the Returning to Work section of the Frequently Asked Questions posted on our EDD website.

# # # # #